is interest paid on new car loan tax deductible

You can write off up to 100. The vast majority of auto loans are not tax deductible.

Chrysler Has A Plan Federal Tax Deductions For Car Loan Payments The Truth About Cars

You can deduct interest on a business loan regardless of whether you use business or personal property for collateral.

. If you are in a lower tax bracket you will not be able to take advantage of. The Interest paid on some types of Loans is allowed to be claimed as an Expense under the Income Tax Act. It is important to consider the tax deductibility of interest when choosing a debt-financing source for your small business.

Salary sacrificing means you can buy big-ticket items using pre-tax dollars with the added bonus of reducing your taxable income. However you can write off part of your car loan interest. If a self-employed person uses their car for business 40 percent of the time and personal use 60 percent of the time then the person can only deduct 40 percent of the loan.

So if you use your car for work 70 of the. The amount you can deduct will depend on. Experts agree that auto loan interest charges arent inherently deductible.

The tax rebates you can claim if youve taken out a chattel mortgage include the GST you paid when buying the car the loan interest youre paying and the cars depreciation. The tax deduction for interest on a car loan is only available for those in the 25 or higher tax bracket. The expense method or the standard mileage deduction when you file your taxes.

So your total taxable profit for the year will be Rs 476. Interest paid on personal loans car loans and credit cards is generally not tax deductible. While the CCA offers tax relief for the overall cost of the vehicle self-employed workers and business owners can also deduct interest on car loans.

Assuming youre in the United States the answer is usually no. This is why you need to list your vehicle as a business expense if you wish to deduct the interest youre. However you may be able to claim interest youve paid when you file your taxes if.

Remember you can only deduct the business-use percentage of your car. None of the interest will be deductible. You can deduct interest on the money you borrow to buy a motor vehicle zero-emission vehicle passenger vehicle or a zero-emission passenger vehicle you use to earn business.

Only those who are self-employed or own their own business and use a vehicle for business purposes may claim a tax deduction for car loan interest. You can deduct the interest paid on an auto loan as a business expense using one of two methods. However all types of interests are not.

The IRS has a Safe Harbor rule that allows you to deduct the interest on the first 25000 of your car loan if you use the car more than 50 of the time for business. The answer to is car loan interest tax deductible is normally no. The amount of the deduction depends.

The interest on a personal loan normally is not tax-deductible because the Internal Revenue Service treats such interest as personal interest. Tax Deduction for Interest paid on Car Loan. If the taxable profit of your business in the current year is Rs 50 lakh Rs 24 lakh 12 of Rs 20 lakh can be deducted from this amount.

A student loan tax. You cant deduct your car payments on your taxes but if youre self-employed and youre financing a car you use for work all or a portion of the auto loan interest may be tax. For example if 70 of your car use was for business and 30 for personal affairs then you can only deduct 70 of the car loan interest from your tax returns.

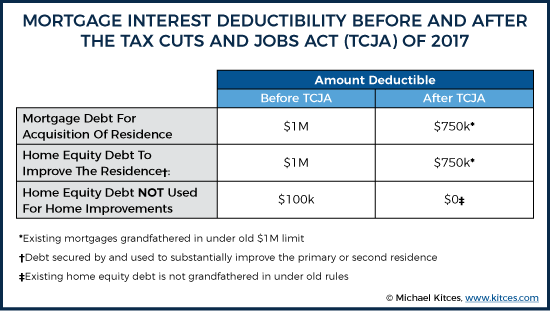

This is because the only interest that is still deductible as an itemized deduction is home mortgage interest and investment interest. It can also be a vehicle you use for both. If you are an employee of someone elses business you are not eligible to claim this deduction.

You will be able to deduct car loan interest from your tax returns only if you own a car for business purposes. In addition interest paid on a loan thats used to purchase a car solely for. Getty Salary packaging is a popular.

Interest paid on personal loans is not tax. But you can deduct these costs from your income tax if its a business car. The only time you can deduct interest on a car loan is if the.

Whether or not the interest is deductible doesnt depend on the type of. Deducting Car Loan Interest HR Block Answer.

Is Car Loan Interest Tax Deductible And How To Write Off Car Payments

Can I Write Off My Car Payment For Tax Purposes

New York Vehicle Sales Tax Fees Calculator

What Is The Washington State Vehicle Sales Tax

Business Vehicle Tax Deduction Calculator Nissan Usa

3 Ways To Better Market Your Auto Loans Cuinsight

Is A Car Loan Interest Tax Deductible Mileiq

6 Surprising Tax Deductions For Uber And Lyft Drivers

Underwriting 101 Auto Finance How Are Car Loans Approved

:max_bytes(150000):strip_icc()/dotdash-070915-personal-loans-vs-car-loans-how-they-differ-v2-f8faff14abb1488d869f4026c406a86c.jpg)

Personal Loans Vs Car Loans What S The Difference

2021 Rideshare And Delivery Driver Tax Deduction Guide Gridwise

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Car Payment Calculator Experian

Home Equity Loans Can Be Tax Deductible Nextadvisor With Time

How To Calculate Your Student Loan Interest Deduction Student Loan Hero

Is A Car Loan Interest Tax Deductible Mileiq